Bank BRI and Traveloka Collaborate to Launch PayLater Card

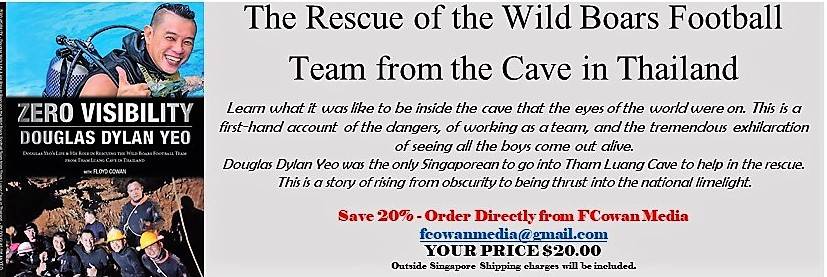

Traveloka, BRI, and Visa representatives gather with stakeholders for the PayLater Card launch. The PayLater Card will give users credit access to transact both with online, and offline merchants anywhere around the world.

Bank BRI and Traveloka have collaborated to develop a proprietary application system, allowing users to apply within five minutes and get approved in one day on average, making the PayLater Card the fastest credit card application process in Indonesia.

(Singapore, 26 September 2019) PT Bank Rakyat Indonesia (Persero) Tbk. or Bank BRI, the leading consumer bank in Indonesia with the largest asset base, and Traveloka, the leading digital travel and lifestyle platform in Southeast Asia, have announced a collaboration to launch PayLater Card.

H.E. I Gede Ngurah Swajaya, Ambassador of Indonesia to Singapore, and Andrew Tan, Chief Financial Officer for Visa in Asia Pacific were on hand for the announcement of collaboration at the Embassy of the Republic of Indonesia, Singapore. PayLater Card offers an innovative channel for credit access to the underbanked Indonesians, transforming user experience through end-to-end card management on Traveloka’s digital platform. The card can be used in Indonesia and around the world for both online and offline transactions by leveraging the network of Visa, the global payment technology company.

(From Left to Right) Visa Regional CFO APAC Andrew Tan, Traveloka Group of Operations President Henry Hendrawan, Bank Rakyat Indonesia Consumer Director Handayani, Ministry of Tourism Indonesia Priyantono Rudito, and Ambassador of the Republic of Indonesia to Singapore H.E. I Gede Ngurah Swajaya sign the Memorandum of Cooperation (MoC) for the PayLater Card.

“As the bank with largest network supported by reliable digital platform,” stated Handayani, Consumer Director, Bank BRI, “this collaboration will give added value to payment landscape for Indonesians. PayLater Card offers a new form of payment and provides unique experience to users, which will complement our unparalleled banking services. In addition, our collaboration with Traveloka as our longstanding strategic partner enabled us to create a comprehensive digital payment ecosystem. This co-branding partnership is also aligned with our credit card marketing strategy to enhance our customer base and market penetration among millennials. PayLater Card marks a new era of credit card business in Indonesia.”

Henry Hendrawan, President, Traveloka Group of Operations stated: “We want to solve user pain points where currently many Indonesian consumers are forced to book their flights and hotels last minute due to lack of credit access typically provided via credit cards. Many of these users ended up paying higher last-minute prices or sometimes are unable to find the airline seat or hotel rooms they want. We couldn’t have hoped for a better partner to tackle this problem. BRI with its leading consumer banking position as well as its strong digital ambitions will allow us to scale the product and address millions of underbanked users in Indonesia.”

(From Left to Right) Visa Regional CFO APAC Andrew Tan, Traveloka Group of Operations President Henry Hendrawan, Bank Rakyat Indonesia Consumer Director Handayani, Ministry of Tourism Indonesia Priyantono Rudito, and Ambassador of the Republic of Indonesia to Singapore H.E. I Gede Ngurah Swajaya gather for the launch of the PayLater Card.

The PayLater Card will provide users with a simple application and verification process that will only take a maximum of one day. The approval will be based on a proprietary credit assessment engine powered by Bank BRI and Traveloka after which, users will be able to activate and manage their PayLater Card directly from Traveloka application.

Henry added that many Indonesians don’t have a typical “job” but that they do work make a great deal of cash. “Filling out a typical application they might not get accepted because they can’t tick all the boxes. “We have a great deal of information about them when they use our website and we can see their buying patterns. We know that they are good candidates for a card, and they can get it through us.”

Apart from being able to buy all Traveloka products and services ranging from extensive travel and lifestyle tickets, enjoying Traveloka Eats and even purchasing insurance for themselves and their families, users will also be able to use the PayLater Card to do online and offline transactions in more than 53 million merchant locations worldwide that accept payment by Visa. (From Left to Right) Visa Regional CFO APAC Andrew Tan, Traveloka Group of Operations President Henry Hendrawan, Bank Rakyat Indonesia Consumer Director Handayani, and Ministry of Tourism Indonesia Priyantono Rudito discuss how the PayLater Card will improve credit access to Indonesia’s underbanked.

(From Left to Right) Visa Regional CFO APAC Andrew Tan, Traveloka Group of Operations President Henry Hendrawan, Bank Rakyat Indonesia Consumer Director Handayani, and Ministry of Tourism Indonesia Priyantono Rudito discuss how the PayLater Card will improve credit access to Indonesia’s underbanked.

“We believe collectively we can achieve our target of 5 million PayLater Cards by 2025, considering the large target addressable market and increasing digital engagement of Indonesian users,” Henry noted.

“Visa is proud to support the launch of the PayLater Card,” said Andrew Tan, Chief Financial Officer, Visa Asia Pacific, “which provides a faster, more secure and more convenient payment option for Indonesians. Together with Bank BRI and Traveloka, we have the opportunity to transform the payment experience for frequent travellers, holidaymakers, and many of the region’s underbanked consumers,”

The Ambassador of the Republic of Indonesia to Singapore, H.E. Ngurah Swajaya, said, “We appreciate and fully support the partnership between these two leading Indonesian companies and a global payment major to create an innovative solution for Indonesians. We hope this partnership helps further cement our country’s position as the largest and most exciting digital economy in Southeast Asia.”