Technology, Changing Travel Flows and Traveller Demographics Emerge as Defining Factors that Shaped Travel in the Last Decade

Revealed by Expedia and HomeAway based on an analysis of primary and secondary data, the travel brands also identified digital transformation, artificial intelligence, Generation Z, personalised travel, sustainable travel and micro-cations as the six key trends that will define travel in 2020 and beyond

Singapore, 3 December 2019 – The travel and tourism industry is one of the largest economic sectors globally, supporting one in 10 jobs worldwide and generating 10.4 percent (US$8.8 trillion) of the world's GDP in 20181. With rapid advancements in technology, changing industry landscape marked by the rise of low-cost carriers and holiday home rentals, along with evolving traveller demographics, the travel industry has seen a wave of changes in the past 10 years, making it one of the fastest growing sectors in the world today.

Based on an analysis of proprietary as well as third-party research data, Expedia and HomeAway have collectively identified the top 10 trends that shaped travel in the last decade, and outlined the six key trends that will define travel in 2020 and beyond.

Here are the details:

1. RISE OF MOBILE

In the last decade, mobile technology has spread rapidly around the globe. Today, there are 5.11 billion unique mobile users in the world, with over half being smartphone connections. At the same time, the rise of mobile has moved us from a mobile-first world to a mobile-only world, and transformed the travel experience. What we do, the way we communicate, and every brand touchpoint is now being driven by mobile. Consumers are expecting travel brands to be on whatever platform they are on and want a seamless and optimised experience across each and every one of those platforms.

For many of our brands at Expedia Group, we take a mobile-first approach to put the future of travel into the hands of our consumers. Globally, more than 50% of traffic arrive on Expedia Group sites via mobile. Our mobile experience has been recognised as the best in Asia Pacific, with Expedia emerging as the most mobile-ready brand by Ansible’s MDEX Study in 2017, and the travel brand with the best mobile experience in Southeast Asia in Google’s Masters of Mobile Southeast Asia Report 2018.

2. GROWTH OF ONLINE TRAVEL

Along with the rise of mobile, the growing internet penetration worldwide continues to fuel the growth of online travel around the world. In Southeast Asia, the online travel sector is growing at a rapid pace. The World Bank’s report into the Digital Economy in Southeast Asia (2019) highlighted that e-commerce in the region is growing rapidly at an estimated CAGR of 27 percent, dominated by the online travel sector and led by a growth in online airline and hotel bookings.

The recent Temasek, Google, Bain & Co e-Conomy SEA 2019 report revealed that the Southeast Asia online travel sector accounted for US$34 billion in 2019, up from US$19 billion in 2015 and is projected to grow to more than double its size to US$78 billion by 2025. In Singapore, online travel has already grown to a US$6 billion industry, forming the largest component of the internet economy, followed by the ride hailing, e-commerce and online media sectors.

3. EMERGENCE OF ARTIFICIAL INTELLIGENCE

Artificial intelligence (AI) has transformed travel in significant ways. AI can help brands to deliver more personalised services, assist consumers to track deals and notify them when travel deals become available. Within the supply ecosystem, hotels and airlines leverage AI in dynamic pricing tools to forecast demand and modify fare prices. Expedia Group launched an AI-powered bot last year to help our lodging partners maximise growth by forecasting demand on specific dates to maximise revenue, and add that inventory upon approval to the Expedia platform for bookings.

In Singapore, AI is being used to enhance travel search query understanding and improve the accuracy of search query resolution in Asian languages. Expedia Group inked a collaboration with AI Singapore under its 100 Experiments (100E) programme earlier this year to leverage natural language processing and machine learning to develop an AI-based model to enhance search query understanding in the Japanese language and other Asian languages. On the customer front, AI is being integrated into the Expedia LINE chat app to improve customer experience.

CHANGING TRAVEL FLOWS

4. RISE OF LOW-COST CARRIERS

According to the Centre for Aviation (CAPA), the number of seats on international low-cost carriers (LCCs) soared 900 percent globally in the past decade. While LCCs took a longer time to take off in Asia Pacific compared to Europe and North America, the LCC share of seats has grown significantly, quadrupling over the last decade. In 2018, LCCs flew nearly 600 million seats within the region, up from approximately 130 million seats in 2008. Today, LCCs account for nearly 30 percent of all airline seats in the region.

Not only have the rise of LCCs driven the bulk of domestic and international passenger growth in the last decade, they have also expanded travel to second-tier cities and destinations in Asia Pacific and around the world.

5. ASIA PACIFIC AS THE MOST DYNAMIC REGION FOR TRAVEL

With rapid economic growth, rising air connectivity and large infrastructure projects, these have contributed significantly to the fast-expanding travel industry in the region, making it the most dynamic and fastest-growing region in the world for travel.

According to the World Tourism Organization’s (UNWTO) Asia Tourism Trends Report, international tourist arrivals in Asia Pacific grew 6 percent in 2017 to reach 323 million, making up around a quarter of the world’s total. The pace of international tourist arrivals in Asia Pacific also outperformed other regions, increasing at an average of 6 percent per year, compared to the world’s average of 4 percent. Today, travel & tourism contributes 9.9 percent of the region’s GDP, coming in as the fifth largest sector ahead of the retail, health, banking and mining sectors. Of the top 10 world’s busiest flight routes recorded from March 2018 to February 2019, eight of them are intra-Asia travel routes, including the Kuala Lumpur – Singapore, Hong Kong – Taipei, Jakarta – Singapore, Jakarta – Kuala Lumpur and Osaka – Incheon routes.

6. GROWING HOLIDAY HOME RENTAL INDUSTRY

The holiday home rental industry has grown tremendously over the last eight years, with greater opportunities for growth among family and group travellers on the road ahead. According to Technavio, the global vacation rental industry will be worth US$193 billion by 2021.

In Asia Pacific, Euromonitor reported that short-term rentals continued to lead lodging growth between 2014 to 2019. The top five destinations in 2019 for Asian holiday home rentals among Singaporeans as identified by HomeAway were Bali, Tokyo, Taiwan, Osaka and Phuket. In Singapore, 77 percent of holiday home users also believe that holiday homes help to cultivate family bonds on holidays.

7. RISE IN DOMESTIC TRAVEL & STAYCATIONS

According to WTTC, domestic tourism has been the leading form of tourism worldwide, representing 73 percent of the total global tourism spend in 2017[16]. In Asia Pacific, domestic travel grew 14 percent in 2018, outpacing the growth of intra-Asia travel which grew by 9.6 percent, as well as intercontinental departures which grew by 4.5 percent.

In Singapore, staycations have been growing in popularity, especially among families with children below 10 years of age who are looking for quick and convenient getaways without the need to leave the country. Expedia’s 2018 Singapore Staycation Study showed that Singaporeans are increasingly avid staycationers – domestic hotel bookings increased by 25 percent year-on-year in 2016, with the rate of growth rising to 40 percent year-on-year in 2017. Additionally, six in 10 Singaporeans have gone on at least one staycation in the past 12 months, with Singaporeans averaging 2.4 staycations per year, coming in just slightly less than the three personal overseas flights they take in a year.

8. BOOMING MUSLIM & CHINESE TRAVEL SECTORS

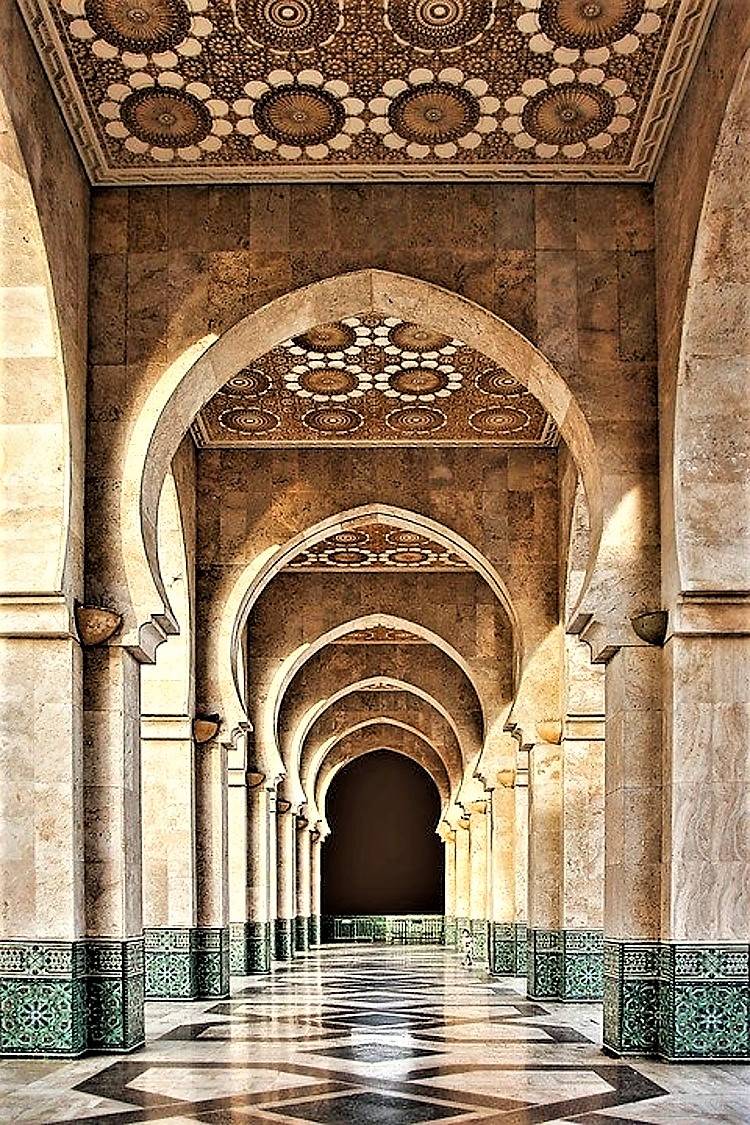

According to the Mastercard-Crescent Rating Global Muslim Travel Index 2019[18], there were 140 million international Muslim travellers in 2018, representing a 43 percent growth from 2010 and 10 percent of the overall travel industry. By 2026, the Muslim travel sector’s contribution to the global economy is expected to jump 35 percent to US$300 billion, up from US$220 billion in 2020.

At the same time, the travel industry in Asia Pacific has benefitted from the booming Chinese travel sector over the last decade, buoyed by the growth in outbound tourism by travellers from Mainland China. In 2009, a total of 47.7 million Chinese travelled overseas. The number has since grown significantly, with Chinese travellers making 149.7 million trips overseas in 2018 and projected to make 178.4 million trips by 2022[19]. Today, many Asia Pacific destinations, including Singapore, consider China as their top source of inbound tourists as well as the top source of inbound tourism.

With the fast-growing Muslim and Chinese travel sectors, this has contributed to the growth of travel and tourism in the Asia Pacific region in the last decade.

EVOLVING TRAVELLER DEMOGRAPHICS

9. COMING OF AGE OF THE MILLENNIAL GENERATION

The millennial generation, born between 1980 and 1994, is the first digitally native generation that grew up with the Internet, social media and smartphones. In the last decade, the rise of the Millennials, many of whom are young professionals and new parents, has brought about significant changes to travel patterns, changes that have caused brands to sit up and adapt their approach to cater to this growing market. Today, Asia is home to the largest proportion of Millennials globally, with approximately 60 percent of the world's millennials residing here. Millennials already account for almost 35 percent of the S$600 billion that Asians spend on international travel and taking an average of 3 trips a year globally.

With the millennial generation poised to become the largest adult population, research has uncovered interesting traits about how they travel. According to the 2017 Expedia Millennial Traveller Report, 59 percent of Millennials in Singapore said that experiencing the authentic culture of a destination is the most important aspect of travelling. The travel choices that Millennials make are also heavily influenced by social media, with 44 percent of Millennials saying that the holiday photos posted by their contacts on social media play a part in influencing their choice of destination, higher than the 30 percent of Generation X and 18 percent of Baby Boomers who shared the same sentiments.

As the travel industry evolves to meet the demands of Millennials, there is a need to actively anticipate their needs. HomeAway connects Millennial families who enjoy travel with the people and places they love, offering value-for-money accommodation for the entire family to be housed under one roof with the full amenities and communal spaces for the children.

10. BLEISURE: THE MARRIAGE OF BUSINESS WITH LEISURE

According to Singapore Tourism Board and McKinsey & Company, Asia accounts for more than a third of the US$1 trillion business travel sector, making it the world's biggest market. 56 percent of Asian business travellers view travel as a perk of their job, with 48 percent interested to extend their business trips for leisure proposes.

The Bleisure Travel Trends report by Expedia Media Solutions revealed that over 60 percent of business trips are extended for leisure purposes, and half of these travellers spend the same amount of money or more on a bleisure trip as compared to a typical vacation. With over 60 percent of business trips in Asia now including a leisure portion, along with the Millennials making up a growing share of bleisure travellers, travel providers are increasingly looking at delivering products and services that can help them save money, ensure safety and make their travel experience more comfortable.

6 KEY TRENDS THAT WILL DEFINE TRAVEL IN 2020 AND BEYOND

1. DIGITAL TRANSFORMATION OF THE TRAVEL INDUSTRY

With the digital transformation wave sweeping across the travel industry, countries are recognising the need to leverage technology to unlock insights from big data and optimise inbound travel flows. Expedia is working with governments and tourism boards in Singapore, Thailand, Malaysia, Japan and Indonesia to help them leverage existing travel and search data to promote inbound tourism, while expanding tourism to second-tier cities. HomeAway also has a joint representative director role within the Japan Association of Vacation Rental (JAVR) to promote vacation rentals, and contribute to tourism in the country. As technology transforms the travel industry, this will demand a very different set of skills from what we see in today’s economy and create new jobs. This calls for governments, tourism boards and travel providers to come together to collectively address the changing nature of jobs, nurture new talents and capabilities that will be in demand in the future, as well as a pool of travel startups that deliver innovative solutions to grow the travel industry.

2. AI & PREDICTIVE ANALYTICS

While the emergence of artificial intelligence (AI) over the last decade has already brought about significant changes to the travel industry, AI will become even more deeply ingrained into the travel industry in 2020 and beyond. Not only will AI empower brands with the ability to deliver more personalised services, it will also enable more personalised engagement with customers. According to Travelport, 65 percent of travellers are willing to provide their personal details if it resulted in a more personalised travel experience. In addition, 68 percent of travel brands are investing in predictive technologies in 2019. This could even remove the ‘search’ step in the travel process by choosing preferred hotels and flights for travellers based on data from their previous trips. On the supply side, AI will also help travel providers to make better forecasts and maximise growth and revenue.

3. RISE OF GENERATION Z

Generation Z, the generation born between 1995 and 2015 that comes after the Millennials, will begin to redefine the rules of engagement for travel marketers in the years to come. According to research by Expedia Group Media Solutions26, Generation Z are deal-driven, frequent travellers who embrace the YOLO (you only live once) mentality and have a passion for activities and bucket list experiences. Today, Generation Z travellers are already taking 2.8 leisure trips per year, just behind the Millennials who take on average of three leisure trips per year, indicating that travel is already a priority for this generation. Generation Z are also heavily influencing their family travel decisions. In the coming years, as more of the Generation Z enter the workforce and increase their disposable income, their prioritisation of travel and growing budgets will unlock myriad opportunities for travel marketers.

4. PERSONALISED TRAVEL

With the explosion of data and technology, travellers are increasingly expecting personalised services from travel providers, ranging from simple add-ons on top of their travel bookings, to surprise holiday recommendations and services. According to Travelport's Global Digital Traveller Research 201927, 42 percent of travellers want to personalise their booking through add-ons such as extra legroom, additional baggage allowance and meal upgrades. Expedia’s 2017 Millennial Travel Report28 also identified several personalisation improvements that Millennials want for an enhanced travel experience – 77 percent are interested in a service that could provide surprise holiday recommendations based on their budget, and 68 percent are interested in a service that could provide surprise holiday recommendations based on their personalities For an effortless, personalised family travel experience, HomeAway has extensive search filters for travellers to shortlist holiday home rental properties based on their specific needs – with the top three trending amenity filters in 2019 being pools, air-conditioning and Wi-Fi. Virtual Tours was recently launched as a customer-centric technological innovation that allows homeowners and property managers to share personal, 360-degree walk-throughs of the property, while Trip Boards was introduced a group planning feature for travellers to save their favourite properties, while enabling them to discuss and plan their trips in collaboration with their travel party.

5. SUSTAINABLE TRAVEL

With climate change, along with the influx of tourists to popular destinations such as Boracay (Philippines), Maya Bay (Thailand) and Japan, there is growing awareness of the need for sustainable travel across the globe. According to Visa, 94 of the top 100 most internationally-visited destinations in 2018 also ranked in the top 100 in each of the past four years, with these top 100 destinations consistently accounting for two-thirds of all international travel, which is not sustainable for the destinations, the people and the natural resources present there. This calls for collective efforts by the industry, including tourism boards, airlines, hotels and travel providers to step up on their sustainability efforts through the installation purified water taps, reduction of single-use plastics, recycling of unused materials and improving energy efficiency. To further these sustainability goals, the Tourism Authority of Thailand (TAT) teamed up with Expedia Group and UNESCO to launch the world’s first UNESCO Sustainable Tourism Pledge, bringing together the parties to support sustainable travel while promoting culture and activities in Thailand in 2020 and beyond.

6. MICRO-CATIONS

With travellers making shorter trips more frequently, micro-cations have been on the rise in recent years and are expected to continue its growth all across Asia Pacific in 2020 and beyond. According to YouGov, Asian family travellers take an average of five micro-cations, more than the two micro-cations taken by their western counterparts. Expedia’s Year In Review 2018 Report also revealed that Singapore travellers took an average of 4.6 overseas trips in 2018, with each trip lasting an average of 2.3 nights, which falls neatly under the micro-cation category. With micro-cation destinations mainly located in Asia, the region is well-placed to provide affordable and accessible travel options to meet a variety of solo, family and group traveller needs. According to the 2019 HomeAway traveller demand data, Christmas and New Year’s Eve were the most popular public holidays to take a long weekend micro-cation.

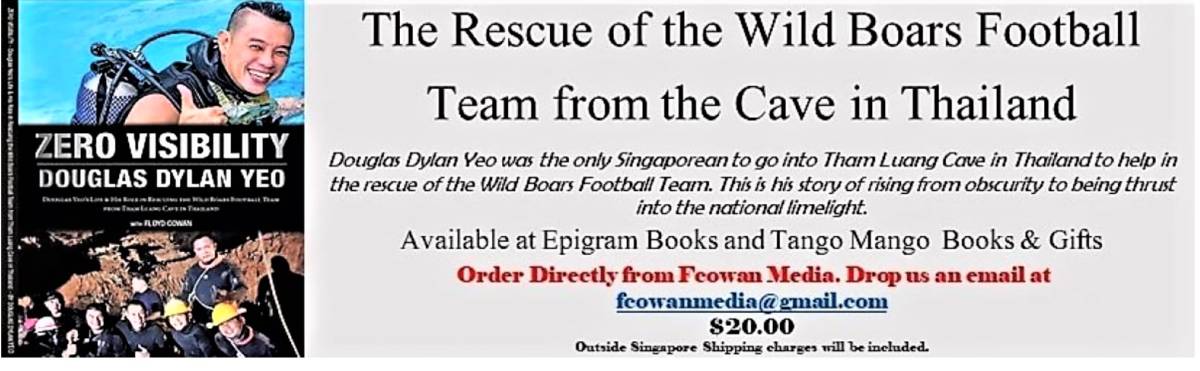

Zero Visibility is now available at Kinokuniya Books Singapore