Withdrawing cash overseas? Wise reveals the most expensive countries to do so among Singaporeans’ favourite travel destinations

The Philippines takes the top spot among locals’ favourite travel haunts as the most expensive country to withdraw cash overseas.

(Singapore, 6 December 2022) With 8 in 10 Singaporeans intending to travel for leisure in the next 12 months, the travel bug is truly back in full swing. Wise, the global technology company building the best way to move money around the world, has dug into its data to reveal the ATM overseas withdrawal rates at Singaporeans’ favourite travel destinations to help travellers avoid exorbitant fees, especially amid rising prices and cost of living.

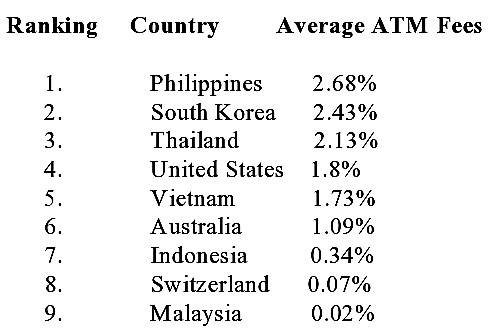

At the top of the list is the Philippines. On average, travellers were charged a withdrawal fee of 2.68% per transaction. Rounding up the top three are South Korea, with a fee of 2.43% and Thailand, at 2.13%. On the flip side, Singaporeans’ favourite weekend travel destination, Malaysia, charges the lowest rate at 0.02% per transaction. (See table below for the full list.)

“We wish to help travellers avoid unnecessary charges and consider alternatives ahead of their trips, especially during the end-of-year travel season. It is important to be aware of hidden costs when withdrawing cash overseas, which can often include foreign transaction fees and undisclosed mark-ups on exchange rates,” said Lim Paik Wan, APAC Expansion Lead at Wise.

“Our data shows that transaction fees range from 0.02 to 2.68%, and these unassumingly small fees can add up. To put this in perspective, if someone withdrew S$150 per day for a week in the Philippines, totalling S$1,050, they’d pay the equivalent of S$28.14 in fees.”

ATM fees at Singaporeans’ favourite travel destinations

To help travellers stretch their holiday budget further, Wise has put together useful tips for holidaymakers to keep in mind during their travel preparation:

● Do your research on where to withdraw your money. It may be cheapest to do this before you leave — however, it’s still best to avoid the money exchangers at the airport.

● Check what fees your card provider charges you. Although most providers allow withdrawals overseas, these are usually very expensive.

○ Some providers may offer free ATM withdrawals abroad up to a certain threshold.

○ To save money, either exchange money before you travel or bring a multi-currency card to withdraw cash once you arrive. With the Wise card, users can withdraw money at ATMs worldwide for free twice a month for amounts under S$350.

○ If you’re able to, “shop around” once you arrive at your destination. If there are several ATMs within a short distance of each other, it may be worth comparing their rates, as fees will vary from bank to bank.

● Never withdraw money on a credit card, as the fees will be very high, and you’ll be charged interest.

● If given an option on how to “pay” when withdrawing money at the machine, make sure you select the local currency.

For more information about Wise, visit http://www.wise.com/sg.